Table of Contents

- Consumer Price Index May 2024 - Roxie Clarette

- The Daily — Consumer Price Index, April 2024

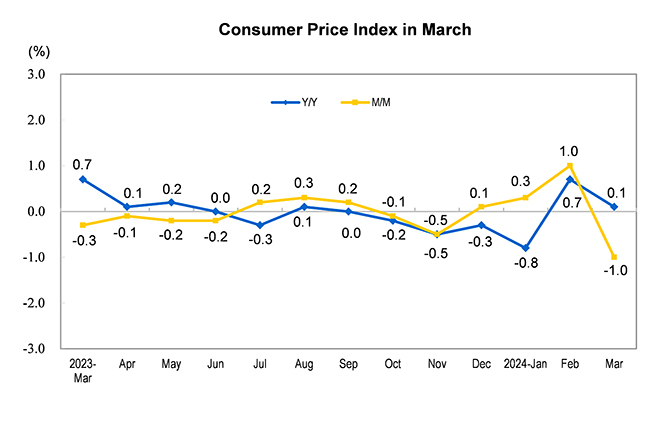

- Consumer Price Index for March 2024

- Group

- Expect a year of two halves from 2024 - Ironfish

- Consumer Price Index: June 2024 Brings the Second Consecutive Month of ...

- Consumer Price Index for July 2024

- Consumer Price Index (CPI) for March 2024 is Projected to Rise 3.4% ...

- An Analysis of the 2024 Consumer Price Index Basket Update, Based on ...

- An Analysis of the 2024 Consumer Price Index Basket Update, Based on ...

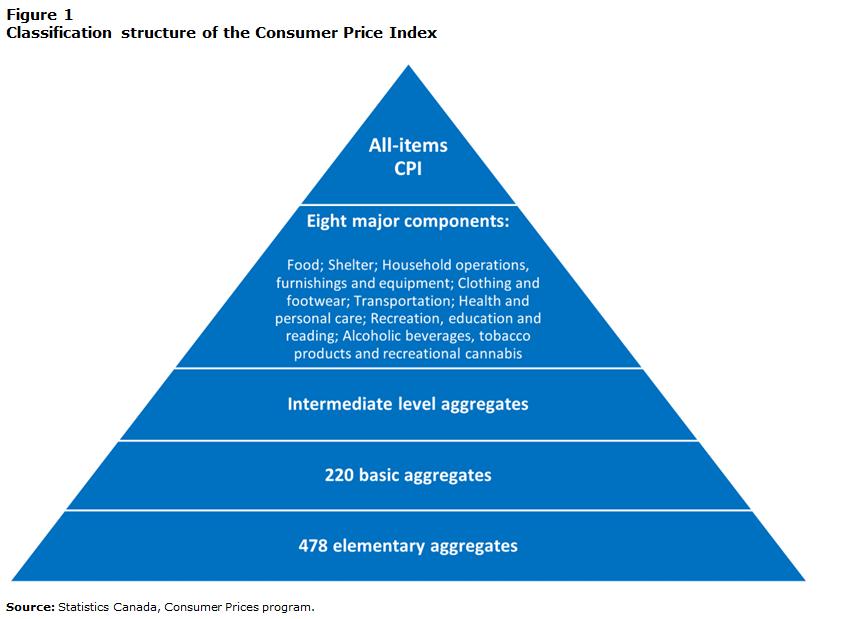

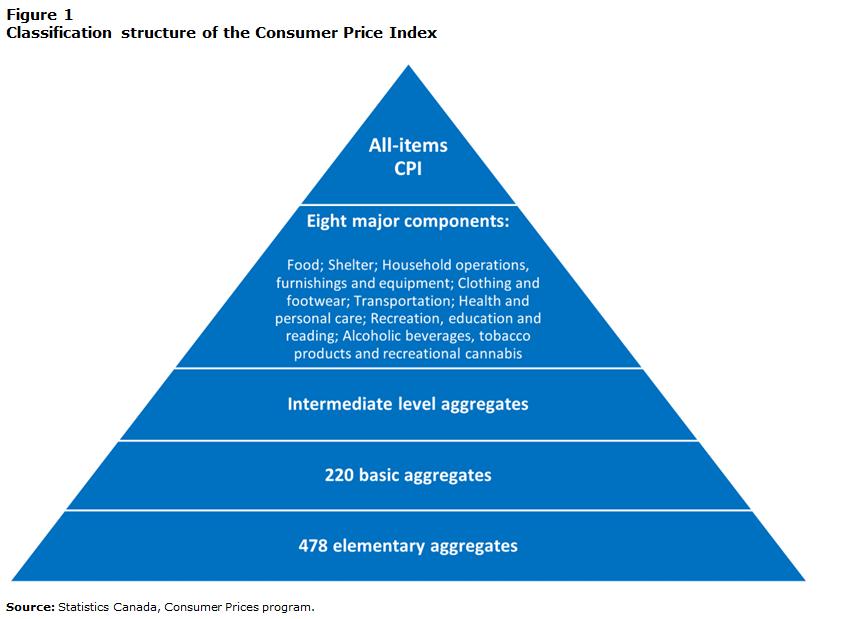

What is the Consumer Price Index?

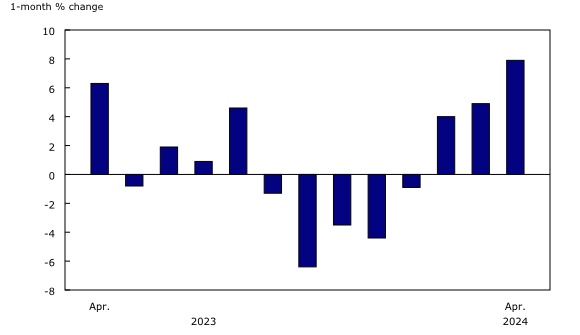

Key Findings from the April 2024 CPI Report

Insight/2024/04.2024/04.09.2024_Consumer Price Index/03-number-of-s%26p-500-companies-citing-inflation-on-earnings-calls-versus-quarterly.png?width=1680&height=960&name=03-number-of-s%26p-500-companies-citing-inflation-on-earnings-calls-versus-quarterly.png)

Implications of the April 2024 CPI Report

The April 2024 CPI report has significant implications for various stakeholders: Consumers: The moderate increase in the CPI suggests that inflation remains under control, which is good news for consumers. However, the rise in food and housing costs may still pose a challenge for households with limited budgets. Businesses: The stable CPI suggests that businesses can maintain their pricing power, which is essential for maintaining profit margins. Policymakers: The CPI report provides valuable insights for policymakers, enabling them to make informed decisions about monetary policy and inflation targeting. The April 2024 CPI report provides a comprehensive overview of the current state of inflation in the economy. The moderate increase in the CPI suggests that the economy is experiencing a period of stable growth, with some upward pressure on prices. As the economy continues to evolve, it is essential to monitor the CPI and other economic indicators to ensure that policymakers and businesses can make informed decisions. By leveraging the data and insights from the FRASER platform, stakeholders can gain a deeper understanding of the economy and make more informed decisions.For more information on the Consumer Price Index and other economic indicators, visit the FRASER platform or the Bureau of Labor Statistics website.

Keyword: Consumer Price Index, CPI, FRASER, inflation, economy, monetary policy, pricing power, households, businesses, policymakers.