Table of Contents

- How Big Will The Raise Be For Social Security In 2025?

- Social Security Changes Announced for 2025 – Retirees Should Prepare

- Social Security Confirms - Disability Benefits Recipients Excluded from ...

- The 2025 Social Security cost-of-living increase will be far smaller ...

- Five Changes to Social Security in 2025 | Kiplinger

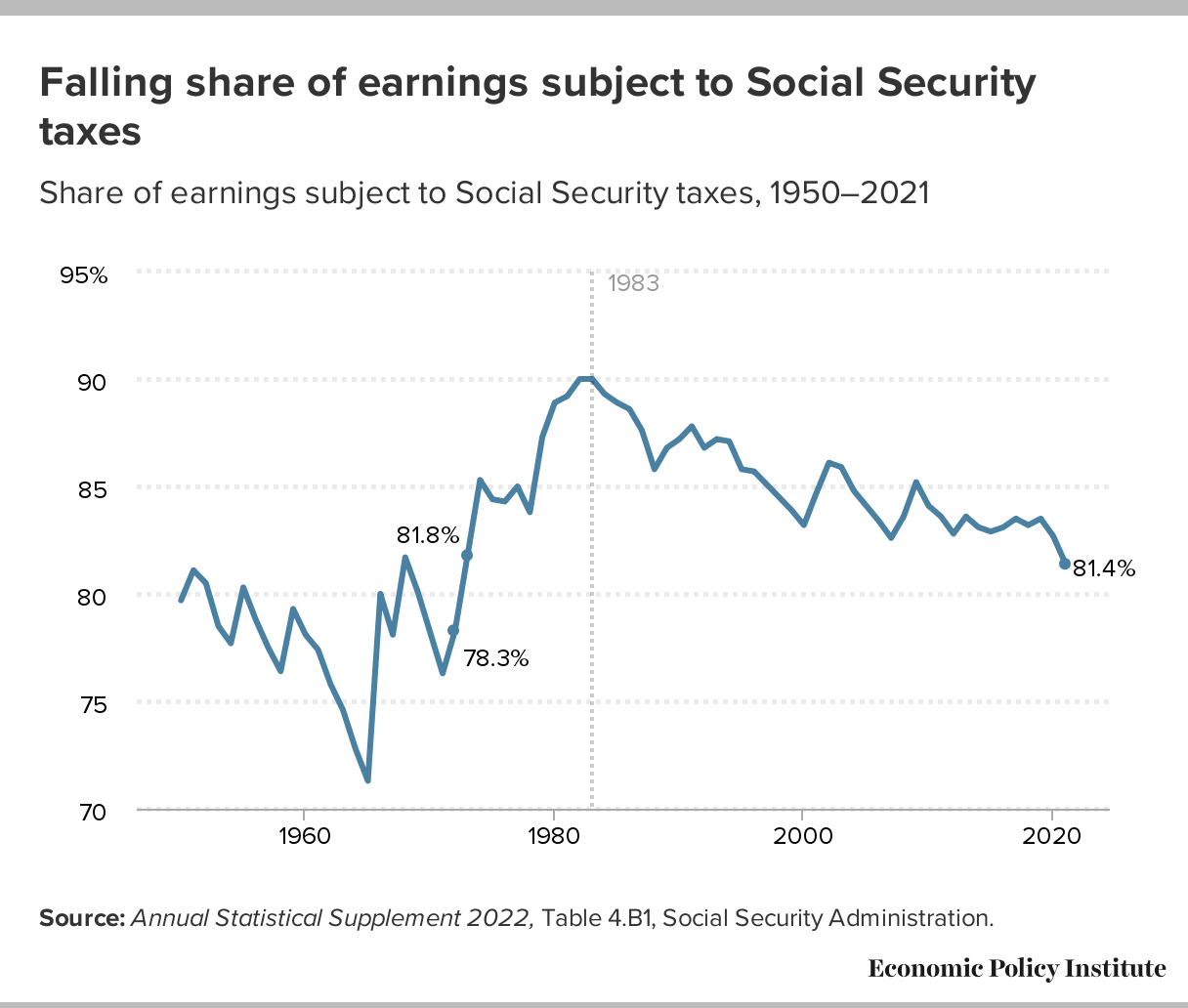

- A record share of earnings was not subject to Social Security taxes in ...

- Social Security Just Released the 2025 COLA. Here's What It Means for ...

- 3 SURPRISES About 2025 Social Security Increase | SSA, SSI, SSDI ...

- Four Projected Changes to Social Security Before 2025

- 2025 Estimated COLA - Social Security Increase! How much will it be ...

The Social Security wage base, also known as the taxable wage base, is the maximum amount of earnings subject to Social Security taxes. For 2025, this base will increase to $157,200, up from $150,000 in 2024. This 4.4% jump may seem minor, but it can have a significant impact on both employees and employers. The increase is tied to the national average wage index, which has been steadily rising over the years.

How the Social Security Wage Base Increase Affects Workers

For example, an individual earning $200,000 per year will pay Social Security taxes on $157,200, which is 4.4% more than the $150,000 threshold in 2024. While this may not seem like a significant increase, it can add up over time. On the other hand, workers earning below the wage base threshold will see no change in their Social Security tax liability.

Implications for Employers

Employers should be aware of the increased wage base and adjust their payroll accordingly. This may involve updating their payroll systems and notifying their employees of the change. Additionally, employers may want to consider the potential impact on their employees' take-home pay and adjust their compensation packages accordingly.

The 4.4% increase in the Social Security wage base for 2025 may seem like a minor change, but it can have significant implications for both workers and employers. As the national average wage index continues to rise, we can expect to see further increases in the wage base in the coming years. By understanding the impact of this change, individuals and businesses can better plan for their financial futures and make informed decisions about their compensation and payroll strategies.Stay ahead of the curve and stay informed about the latest updates and changes that may impact your finances. Whether you're an individual or a business, it's essential to be aware of the Social Security wage base increase and its implications for your financial situation. With the right knowledge and planning, you can navigate the complexities of the Social Security system and make the most of your hard-earned money.